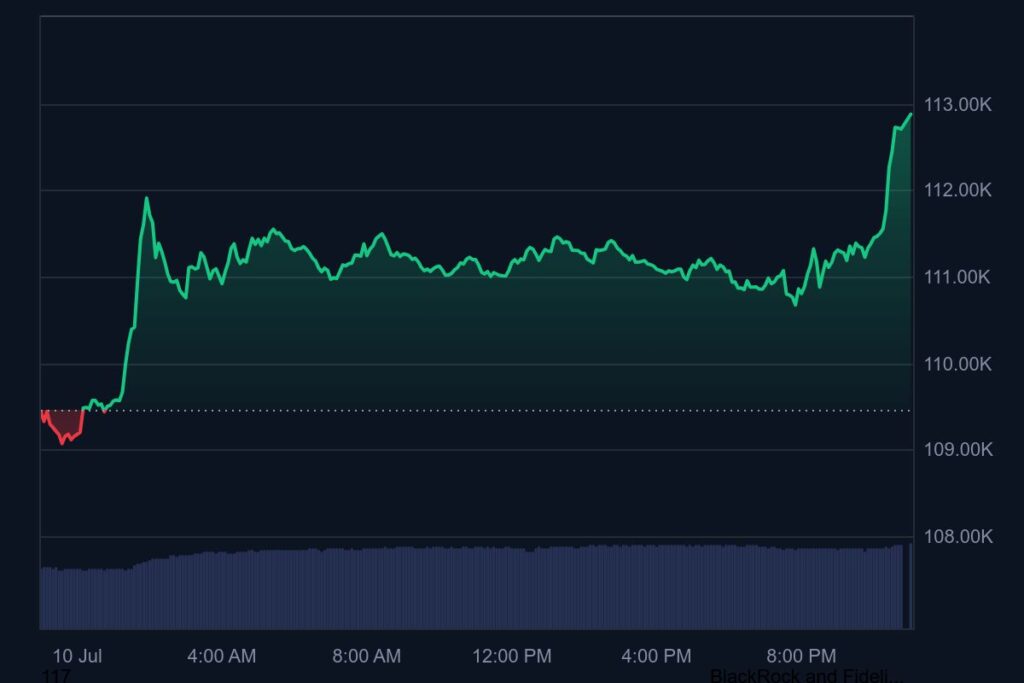

Today, July 10, 2025, Bitcoin has smashed through a new all-time high (ATH), igniting a crypto market rally that’s sending prices soaring. With BTC climbing past $112,000 and altcoins riding the wave, excitement is palpable, though posts found on X reveal a mix of jubilation and skepticism about the sustainability of this surge. Is this a historic bull run, or a bubble ready to burst? Let’s unpack the frenzy.

Bitcoin’s Record-Breaking Climb

The spotlight blazes as Bitcoin surges to $112,509.65, topping its May peak, driven by institutional inflows into spot ETFs and corporate treasury adoption, with firms like MicroStrategy adding 10,000 BTC in June. The market cap nears $3.5 trillion, but X chatter hints at overleveraged retail traders, with some warning that a 4% dip could trigger a crash, questioning whether this rally rests on solid ground.

Altcoins Join the Pump

Momentum spreads as Ethereum jumps 6% to $2,575 and meme coins like $TRUMP spike, fueled by speculative fervor and regulatory hints like the GENIUS Act’s Senate push. X users note 90% of altcoins lag their ATHs, suggesting untapped potential, yet the lack of volume compared to past bull runs—down 300% from 2021—raises doubts about whether this pump reflects genuine demand or artificial hype.

Drivers Behind the Surge

The rally accelerates with U.S. pro-crypto policies under Trump, including a strategic Bitcoin reserve, boosting sentiment, while easing trade tensions and a Moody’s U.S. debt downgrade push investors toward digital assets. X posts highlight $5.69 billion in ETF inflows over five weeks, but critics argue this mirrors past cycles where policy optimism outpaced fundamentals, risking a correction if regulations falter.

The Road Ahead

The future teeters as analysts predict $120,000-$150,000 by year-end, with institutional demand absorbing supply faster than mining, yet a potential China mining ban looms. X speculation of bearish bankruptcies if BTC hits $121,000 contrasts with hopes of a $444,000 peak by 2026, leaving the market’s trajectory a gamble amid volatility and untested resilience.

A High-Stakes Rollercoaster

Bitcoin’s new ATH in 2025 sparks a crypto market pump, blending opportunity with risk as hype fuels the climb. The rally’s strength is undeniable, but its longevity hinges on regulation and adoption—can this momentum hold, or will it fade?

Share your take—is this crypto pump a sign of growth, or a warning?