DUBAI/GLOBAL— The total cryptocurrency market capitalization has surged by over $300 billion in a massive relief rally, driven by a market-wide short squeeze following the announcement of a ceasefire in the Middle East. The influx of capital marks a sharp reversal from last week’s brutal sell-off, which saw over $500 billion wiped from the market amidst escalating geopolitical fears.

The conflict had triggered a classic “risk-off” cascade. On-chain data revealed that as news of potential Western military involvement broke, funding rates for perpetual futures went deeply negative, indicating traders were overwhelmingly bearish and paying high fees to short the market. This led to cascading liquidations, with Bitcoin (BTC) crashing through the $90,000 support level and triggering stop-losses across the board.

However, the ceasefire news, brokered by the diplomatic efforts of Russia and China, acted as a powerful catalyst for a reversal. The sudden positive development caught short-sellers off guard. As the market began to tick up, these traders were forced to buy back assets to cover their positions, adding immense buying pressure and creating a textbook short squeeze.

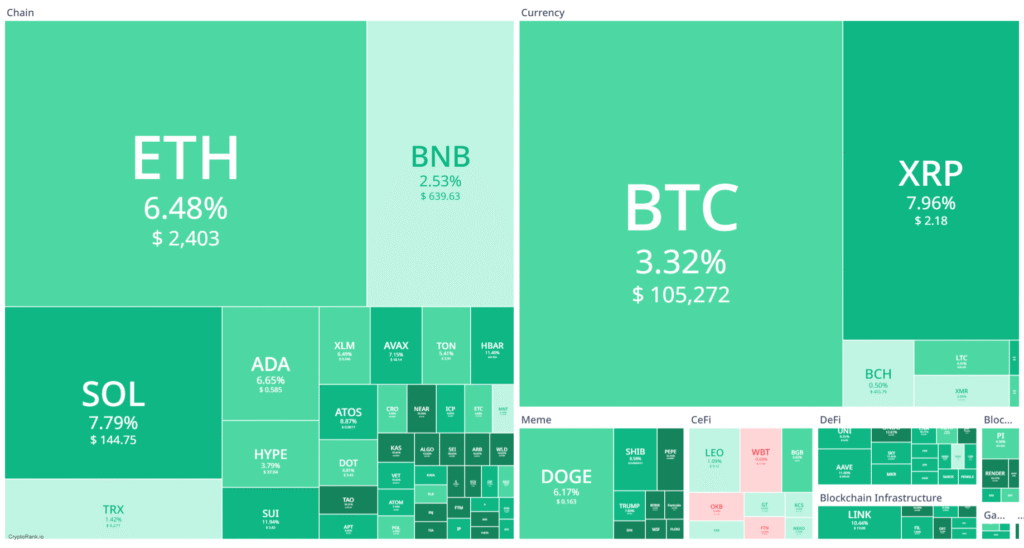

Data analytics platforms, including CryptoRank, illustrate the scale of the recovery. Market heatmaps, which were a sea of red just 48 hours ago, are now overwhelmingly green.

- Bitcoin (BTC) is up over 12%, smashing through the $105,000 resistance level.

- Major layer-1 chains like Ethereum (ETH) and Solana (SOL) have posted gains of 15% and 22%, respectively, showing that capital is confidently flowing back into the ecosystem’s core infrastructure.

- Even high-beta assets like memecoins, led by Dogecoin (DOGE), are seeing significant double-digit pumps as retail sentiment turns bullish.

While the market sentiment is now euphoric, with the Crypto Fear & Greed Index flipping from “Extreme Fear” to “Greed,” professional traders remain cautiously optimistic. An analyst commented, “This rally is driven by the liquidation of leveraged short positions. For it to be sustainable, we need to see continued spot-driven buying and an increase in stablecoin inflows to exchanges. The geopolitical situation, despite the hardline rhetoric from nations like North Korea, is stable for now, but any disruption could challenge this fragile recovery.”

For now, the market is celebrating the return of stability, proving once again how sensitive the digital asset space is to global macroeconomic and geopolitical events.